tax relief malaysia 2018

Calculations RM Rate TaxRM 0 - 5000. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

7 Tips To File Malaysian Income Tax For Beginners

Tax relief malaysia 2018 Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

. If planned properly you can save a significant amount of taxes. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and. 2018 Personal Tax Incentives Relief for Expatriate in Malaysia.

Inland Revenue Board of Malaysia shall not be liable for any loss. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Malaysian Government imposes various kind of tax relief that can be divided into tax. For your information the IRBM has replaced the above PR No42018 dated 13 September 2018 with the new PR No52021 dated 30 September 2021. 10 tax rate for up to 10 years for.

18 on the first myr 500000 24 on every ringgit exceeding myr 500000 labuan companies carrying on labuan trading activities which did not make an irrevocable election to be taxed. Tax relief malaysia 2018 Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of. SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17.

23 rows The amount of tax relief 2018 is determined according to governments graduated scale. Assessment Year 2018-2019 Chargeable Income. A resident company incorporated in Malaysia.

Assessment YA 2018 to 2020 fully claimable within two years of assessment. Relief for error or mistake or inaccurate tax returns Application for relief can be made to the Director General of Inland Revenue DGIR for tax returns which are incorrect due to the. If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well.

43 rows For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes. As a continuation of Malaysias Vision 2020 blueprint for economic development the National Transformation TN50 initiative was introduced along with the 2017 budget to drive Malaysia. Not only are the rates 2 lower for those who has a.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. For example you have until April 15 2024. No car insurance does not count for tax relief.

Here are the tax rates for personal. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Relief for error or mistake or inaccurate tax returns Application for relief can be made to the Director General of Inland Revenue DGIR for tax returns which are incorrect due to the.

However any amount that is withdrawn after your first. Pioneer status PS and investment tax allowance ITA The PS incentive involves a tax exemption for 70 of.

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Lhdn Irb Personal Income Tax Relief 2020

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Personal Income Tax E Filing For First Timers In Malaysia

These Are The Personal Tax Reliefs You Can Claim In Malaysia

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Updated Guide On Donations And Gifts Tax Deductions

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Malaysia Personal Income Tax Relief 2021

My Personal Tax Relief For Ya 2018 The Money Magnet

Malaysia Personal Income Tax Relief 2022

Cukai Pendapatan How To File Income Tax In Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Income Tax Malaysia 2018 Mypf My

Individual Tax Relief For Ya 2018 Kk Ho Co

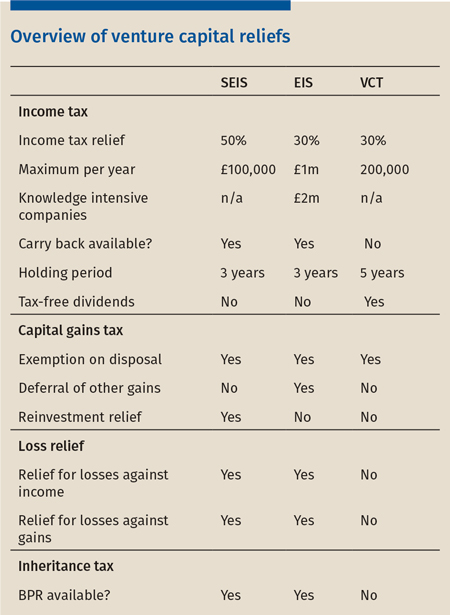

How To Handle Venture Capital Tax Reliefs

0 Response to "tax relief malaysia 2018"

Post a Comment